Benefites of SBI Credit Card Total Benefits...

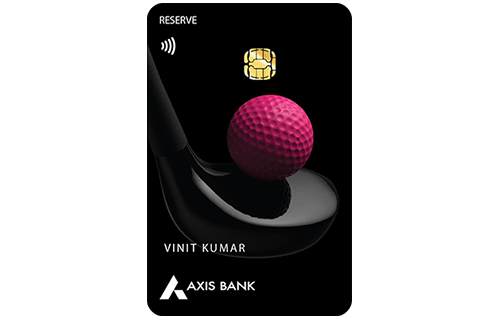

Axis Bank Reserve Credit Card is the most premium offering by the bank. It is a super premium credit card and offers an effective reward rate of 1.5% on domestic spends and 2x reward points on international transactions made with the card. It is a Reward Points-based card- you earn Axis Bank Edge Reward Points on all spends made with Axis Bank Reserve Credit Card. Since it is a super-premium credit card, apart from the Reward Points benefit, the card comes packed with a plethora of value-added privileges like complimentary domestic and international airport lounge access, membership of hotel loyalty programs like ITC Culinaire, Accor plus & Club Marriott, membership of dining programs like Eazydiner Prime and many other add-on benefits. Read on to learn more about Axis Bank Reserve Credit Card.

New Features

Complimentary Eazydiner Prime membership offering 25% off at various restaurants, 20% off at participating restaurants with the Dining Delights program, Buy One Get One offer on BookMyShow where you get a maximum of Rs. 500 off on the second ticket, 5 times a month.

15 Edge Reward Points per Rs. 200 spent with the card, 2X Edge Reward Points on all international spends

Axis Bank Edge Reward Points can be redeemed for instant vouchers and exclusive products on the bank’s Edge Rewards redemption portal

Nil

Being a premium credit card, you get over 50 complimentary golf rounds with this card. Unlimited domestic and international lounge access with the Axis Bank Reserve Credit Card.