Benefites of SBI Credit Card Total Benefits...

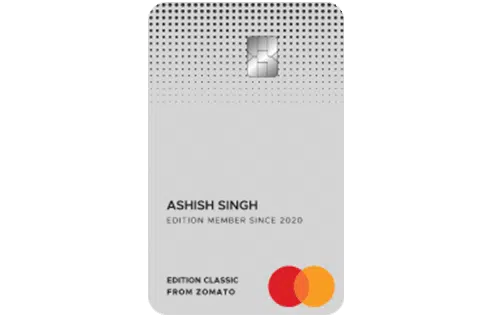

Food delivery startup Zomato jumped on the bandwagon with the likes of Amazon, Flipkart, and BookMyShow and entered the fintech space in March last year when it collaborated with the RBL Bank and MasterCard to launch two credit cards- the RBL Edition and the Edition Classic cards, that offer exclusive dining benefits to Zomato users. The Edition card is the more premium version of the Edition Classic card. With the Zomato Edition Classic credit card, you get complimentary annual Zomato Pro membership (which renews every year) and 500 Edition Cash as a Welcome Benefit. The Edition Cash is just like Reward Points, which can be redeemed for food purchases from Zomato or against the card’s statement balance. 1 Edition Cash is equivalent to INR 1. You also earn accelerated Edition Cash on food purchases from Zomato (5x) and for other purchases (1x). Also, earn up to 2,000 bonus Edition cash annually on the basis of your yearly spending. Keep reading to know more about the benefits of the RBL Bank Zomato Edition Classic Credit Card.

New Features

NA

3.99% per month (or 47.88% annually)

Nil

Nil

1% fuel surcharge levied on all fuel purchases, subject to a minimum charge of Rs. 10 (fuel surcharge waived for select cardholders for transactions between Rs. 500 & Rs. 4,000)

Up to 3.5% (plus applicable taxes)

2.5% of the withdrawn amount (minimum charge of Rs. 500)

Complimentary annual Zomato Pro membership and accelerated reward points on dining.

NA

NA

5 Edition Cash per Rs. 100 spent on Zomato and Blinkit, 1 Edition Cash per Rs. 100 on all other spends.

NA

NA

Edition Cash is redeemable for food purchases on Zomato or against the statement balance. 1 Edition Cash = Re. 1.

NA

Bank is not liable for any unathoirzed usage of the card until the card is blocked.

No data available

No data available