Benefites of SBI Credit Card Total Benefits...

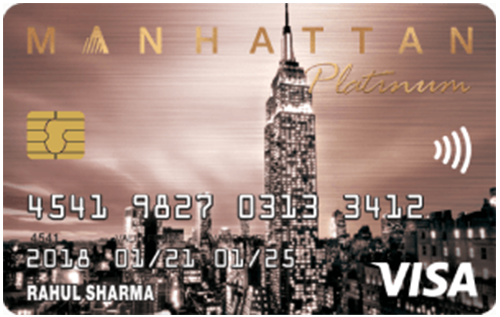

The Standard Chartered Manhattan Credit Card is a basic credit card offered by the Standard Chartered bank in order to deliver its cardholders with premier benefits and rewards. You get an assured cashback of 5% on groceries, supermarkets, and departmental stores with this card. On other spends, get 3 reward points per Rs. 150 spent. You can redeem the reward points for a number of options present on the 360-degree rewards portal. The card carries a joining fee of Rs. 999 and the cardholders are welcomed with a bonus of 5,000 Reward Points. Also, the card carries a nominal annual fee of Rs. 999 and that too can be waived off depending upon your total spends in the previous year. To know more about the Standard Chartered Manhattan Credit Card, and its features, keep reading:

New Features

The renewal fee can be waived if you spend Rs. 1,20,000 or more in the preceeding year.

3.75% per month (45% per annum)

Nil

Rs 99 per redemption request

1% fuel surcharge is applicable subject to a minimum of Rs. 10.

3.5% on all overseas transactions

3% of the amount withdrawn or Rs. 300 (whichever is higher)

NA

NA

NA

3 Reward Points per Rs. 150 you spend, and 5% cashback on departmental stores, groceries, and supermarkets.

NA

NA

The earned reward points are redeemable on the 360-degree Rewards portal. Here, 1 RP = Rs. 0.25.

NA

Zero liability protection in case the card is stolen or lost and the same is reported to the bank.

No data available

No data available