Benefites of SBI Credit Card Total Benefits...

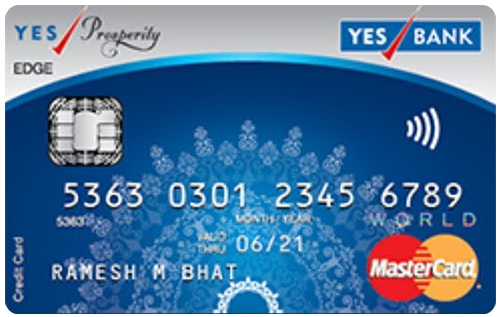

The YES Bank Prosperity Edge credit card comes with exclusive rewards to provide its customers with a prosperous life as suggested by its name. It comes with exciting rewards & offers and many other benefits. Although the YES Prosperity Edge card has advantages over various different categories, it is best suited for people who are more interested in saving through reward points. With a joining fee of Rs. 399, it has some really great key features, such as exciting reward points, spend-based bonus offers, Joining & renewal fee waivers, complimentary travel benefits, fuel surcharge waivers, etc. The joining fee you pay can be waived off if you spend over Rs. 15,000 within 90 days after receiving your YES Prosperity Edge credit card. A spend-based renewal fee waiver is also provided to the cardholders according to which, the renewal fee will be waived off on spending Rs. 75,000 or more in the previous year. This was just a glimpse of the card & its benefits; to know more, refer to the information given below:

New Features

Joining fee waiver on spending Rs. 15,000 or more within 90 days after receiving the card and the renewal fee is waived off on a spend of Rs. 75,000 or more in the previous year.

3.8% per month

Nil

Rs. 100 on every redemption request.

1% fuel surcharge waiver at all the fuel stations in India for all the transactions between Rs. 400 and Rs. 5,000.

2.75% on all foreign currency spends

3.5% of the amount withdrawn

8 Reward Points on every Rs. 200 on Dining Spends

1 complimentary domestic lounge access per quarter.

You get complimentary international lounge access Priority Pass membership at a charge of USD 27 per person

4 Reward Points on every Rs. 200 spent on all categories except select categories, 2 Reward Points on every Rs. 200 spent on select categories and 8 Reward Points per Rs. 200 spent on dining and travel

4 complimentary rounds of green fees every year and 1 complimentary golf lesson each month.

A cover worth Rs. 50 lakhs for death due to air accident and medical insurance worth Rs 15 lakhs.

Reward Points redeemable for movie ticket bookings on YES Rewardz portal at a rate of 1 Reward Point = Re. 0.25 for redemption against hotel/flight bookings, and 1 Reward Point = Re. 0.10 for redemption against gift vouchers, product catalogue, etc.

You get 1 complimentary domestic lounge access per calendar quarter subject to 2 visits per quarter.

You get a protection liability cover in case of the fraudulent charges, if reported within a stipulated time

No data available

No data available