Benefites of SBI Credit Card Total Benefits...

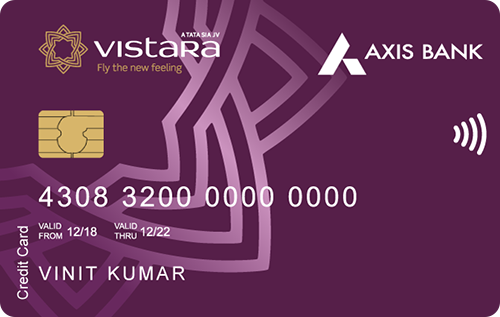

The Axis Bank Vistara Credit Card is a card issued by Axis Bank with an aim to make their customers’ travel experiences better. With this card, you’ll earn Club Vistara Points as rewards on every spend. You get 2 Club Vistara Points for every Rs. 200 you spend, which can be redeemed easily against flight bookings on the Club Vistara website. The card also provides 2 complimentary airport lounge access every quarter at several participating lounges in India. Not only travel, but you also get exciting discount offers on dining with the Axis Bank Dining Delights. The card comes with a nominal joining fee of Rs. 1,500 and welcomes you with a complimentary economy class ticket voucher. You can also earn bonus Club Vistara Points based on your first three months’ spends and up to 3 complimentary economy class ticket vouchers on the basis of your annual spends. Along with all this, there are many more advantages of the Axis Bank Vistara Credit Card. To know all of them, keep reading the detailed information given below:

New Features

25% discount up to Rs. 800 at restaurants with the Axis Bank EazyDiner Program

Club Vistara Base Membership and complimentary domestic lounge access every quarter.

None

2 CV (Club Vistara) Points per Rs. 200 spent

N/A

Rs. 1 Lakh Purchase protection Cover. USD 300 cover for loss of travel documents, delay or loss of check-in baggage.

Club Vistara Points you earn can be redeemed easily by logging in to the Club Vistara official website

2 complimentary domestic lounge access per quarter

Nil

No data available