Benefites of SBI Credit Card Total Benefits...

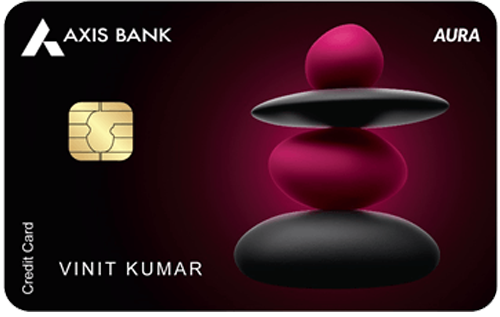

Axis Bank AURA Credit Card is a one of its kind credit card by Axis Bank targeted at ultra health-conscious individuals. The YES Bank also offers one such card targeted at providing health benefits, which is the YES Bank Wellness Credit Card. The card was launched earlier this year at a time when everyone is becoming increasingly more health-conscious due to the prevailing pandemic situation. From free video consultations with doctors to complimentary fitness sessions and discounted rates on nutritional foods, the card offers plenty of medical and fitness benefits. As far as the card’s reward rate is concerned, you earn 2 EDGE Points per Rs. 200 spent with the card and 5X EDGE Points on insurance spends. 1 EDGE Point is valued at Rs. 0.20, making the effective reward rate of the card 1% on insurance spends and 0.20% on all other spends categories. Read on to learn more about this unique offering by Axis Bank.

New Features

N/A

3.40% per month (or 49.36% annually)

Nil

Nil

1% fuel surcharge waived off at all fuel stations for transactions between Rs. 400 and Rs. 4,000 (max waiver of Rs. 250 in a month)

3.5% of the transaction amount

3.4% of the withdrawn amount or a minimum of Rs. 500

Up to a 20% discount on dining at partner restaurants.

N/A

N/A

2 EDGE Points on every spend of Rs. 200 with the card and 5x EDGE Points on insurance spends.

N/A

N/A

EDGE Points earned on the card are redeemable for shopping/travel vouchers and for purchasing products (from the given catalog) on the Axis Bank EDGE Rewards Portal.

N/A

Cardholder shall not be liable for any fraudulent transaction made with the card post reporting the loss of card to the bank

No data available

No data available