Benefites of SBI Credit Card Total Benefits...

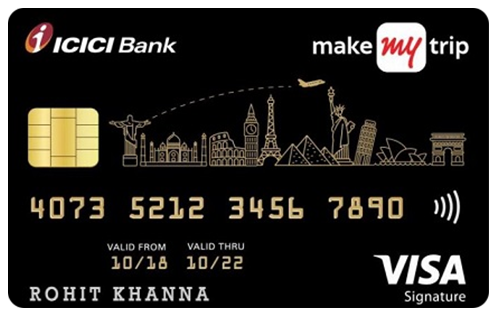

Issued by ICICI Bank, the MakeMyTrip ICICI Bank Signature credit card is a co-branded card that offers exclusive travel benefits in collaboration with MakeMyTrip. The card is issued at a joining fee of Rs. 2,500 and offers exciting welcome gifts such as 1,500 My Cash & a MakeMyTrip holiday voucher (worth Rs. 2,500). The card provides you with My Cash (rewards) on almost all your spending and extra My cash on purchases made on MakeMyTrip. These rewards (My Cash) are redeemable against booking flights/hotels/holidays on MakeMyTrip. Moreover, you get bonus My Cash rewards based on your spending in an anniversary year. Talking about its travel benefits, you get 2 complimentary access to domestic airport lounges per quarter and 1 complimentary railway lounge access every quarter. Not only this, but the card also offers exclusive discounts on movies & dining through this card. The MakeMyTrip ICICI Bank Signature Credit Card provides you with several other benefits. Keep reading to know more about such benefits in detail:

New Features

Nil

3.5% per month (42% annually)

Rs. 250 (plus applicable taxes)

Rs. 99 (plus applicable taxes) pre redemption request

1% fuel surcharge is waived off

3.5% on all foreign currency transactions

2.5% of the withdrawal amount, subject to a minimum of Rs. 300

A discount of 25% on movie tickets through Bookmyshow & Inox, Exclusive discount offers on dining through the Culinary Treats Programme of ICICI Bank.

You get complimentary domestic & international lounge visits quarterly.

1 Complimentary international lounge visit via Dreamfolks membership.

1.25 My Cash on every domestic spend of Rs. 200 and 1.5 My Cash per international spend of Rs. 200.

N/A

N/A

The rewards you earn are transferred to MakeMyTrip My Wallet as My Cash.

2 complimentary access to domestic lounges per quarter on spending over Rs. 5,000 in a quarter.

The cardholder will not be held liable for any fraudulent transactions done after the issue has been reported.

No data available

No data available