Benefites of SBI Credit Card Total Benefits...

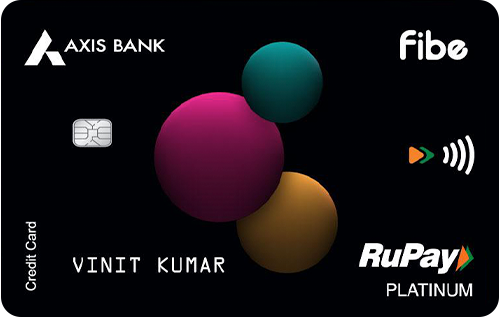

Axis Bank has launched the first numberless credit card in India. It would ensure more safety and security for users as the card would feature only a chip without any details such as Expiry and CVV on it. This is a co-branded credit card presented by the association between Axis Bank and FIBE. This credit card offers primary benefits to users. Being a lifetime free credit card, this card will be especially attractive and lucrative for first-time credit card holders. Whether looking to begin your credit journey or for a UPI Credit Card, this offering by Axis Bank is highly beneficial. You can easily link this card to your UPI applications and start making transactions. You can get direct cashback of up to 3% with this card and also four complimentary domestic lounge access with this card. Keep on reading to learn more about the benefits and fees of this RuPay Credit Card.

New Features

N/A

3.6% Per Month (52.86% Yearly)

N/A

N/A

1% up to Rs. 400

3.5% of the Transaction Amount

2.5% of the Transaction Amount or a Minimum of Rs. 500

3% Cashback on Entertainment Spends & 15% Off With the Axis Bank Dinning Delights Program.

Domestic Lounge Access Available

N/A

3% Cashback on Entertainment, Food Delivery & Commute

N/A

N/A

Direct Cashback

4 in a Calendar Year

Protection Against Fraudulent Transactions if the Theft or Loss is Reported to the Bank in a Timely Manner

Make seamless UPI transactions with this credit card. Enjoy 3% cashback on entertainment, commute and food delivery.

No welcome benefits are provided with this card. This card offers an introductory cashback on a few categories.