Benefites of SBI Credit Card Total Benefits...

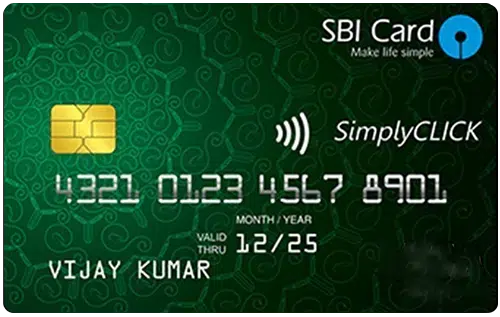

The SBI SimplyCLICK Credit Card is an entry-level shopping credit card offered by SBI Card. It is among the most popular SBI credit cards in the entry-level segment, especially among first-time cardholders. This card is best suited for online shopping because it offers 10x reward points at some of the most popular online shopping and travel websites, including Cleartrip, Apollo24x7, Netmeds, BookMyShow, Dominos, Yatra, and Lenskart. Previously, Amazon was also included in the 10x Rewards list, but the offer no longer applies to Amazon, and the card now only offers 5x Rewards on Amazon. For other online and offline spending, you earn 5x rewards on online spends and one reward point for every Rs. 100 spent on all offline purchases. The SimplyCLICK SBI Card is an affordable entry-level option with an annual membership fee of only Rs. 499. While it may not offer the typical travel, dining, or movie perks that premium credit cards often do, it does provide the chance to earn gift vouchers worth up to Rs. 4,000 per year by meeting the spending requirements. Additionally, this card enables contactless payments and is accepted globally. To learn more about this entry-level credit card, continue reading our SBI SimplyCLICK Credit Card review.

New Features

Renewal fee waiver on annual spend of Rs. one lakh.

3.5% per month or 42% annualized

Nil

Rs. 99 (plus taxes) on each redemption request

1% fuel surcharge waived on fuel transactions from Rs. 500 to Rs. 3,000 (max waiver capped at Rs. 100 per month)

3.5% of the total transaction amount

2.5% of the withdrawal amount or a minimum fee of Rs. 500

N/A

N/A

N/A

Get 10X Reward Points on partner brands (e.g. BookMyShow, Apollo 24/7), 5X Reward Points on online purchases, and 1 Reward Point for every Rs. 100 spent on other purchases.

N/A

N/A

Reward Points can be redeemed for gift vouchers on sbicard.com or via the SBI mobile app, as well as for paying the card’s outstanding balance, 1 RP = Rs. 0.25

N/A

The cardholders get a zero liability protection against a lost/stolen card if the loss is informed to the bank officials timely.

One of the most beneficial pros of the SBI SimplyClick Credit Card is the welcome benefit of a voucher worth Rs. 500 from Amazon. You can also get coupons worth Rs. 4000 on achieving milestone spends.

This card has a significant drawback for frequent travellers as it offers no domestic or international lounge access. Along with no travel benefits, there aren’t any insurance benefits with the SBI SimplyClick Credit Card.