Benefites of SBI Credit Card Total Benefits...

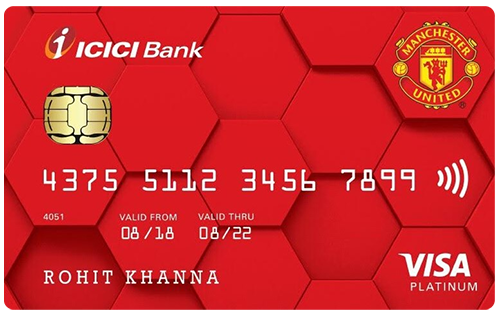

MakeMyTrip ICICI Bank Platinum Credit Card is a co-branded travel credit card issued by the ICICI Bank, just like the Yatra SBI Credit Card issued by SBI. The MakeMyTrip ICICI Platinum Card comes with a joining fee of Rs. 500, but you need not pay any annual renewal fee for the card. The reward points earned on the MakeMyTrip Platinum Credit Card are directly transferred to your MakeMyTrip wallet as My Cash which can be redeemed for various travel expenses like hotel reservations, flight bookings, car rentals, etc. on MakeMyTrip. Read on to learn more about this co-branded travel credit card by ICICI and MakeMyTrip.

New Features

N/A

3.4% per month (or 40.8% per annum)

Rs. 250 (plus applicable taxes)

Rs. 99 (plus applicable taxes) per redemption request

1% waiver on maximum transaction of Rs. 4000 at HPCL pumps in India

3.5% of the transaction amount

2.5% of the withdrawal amount

25% discount (up to Rs. 100) on movie tickets on booking 2 tickets in a single transaction on BookMyShow and INOX (max 2 times in a month)

Comlimentary railway and domestic airport lounge access every quarter

N/A

Rs. 3 My Cash per Rs. 200 on hotel/holiday bookings on MMT, Rs. 2 My Cash on flight bookings on MMT, Rs. 1.25 My Cash on all international spends outside MMT, Re. 1 My Cash on all domestic spends outside MMT

N/A

N/A

MakeMyTrip My Cash earned on the card can be redeemed for flight/hotel/holiday bookings on MakeMyTrip. There is no restriction in terms of the My Cash amount that can be redeemed. 1 My Cash = Re. 1.

1 complimentary domestic airport lounge access every quarter if a minimum of Rs. 5,000 were spent in the previous quarter.

Cardholder shall not be liable for any fraudulent transaction made with the card post reporting the loss of card to the bank.

No data available

No data available