Benefites of SBI Credit Card Total Benefits...

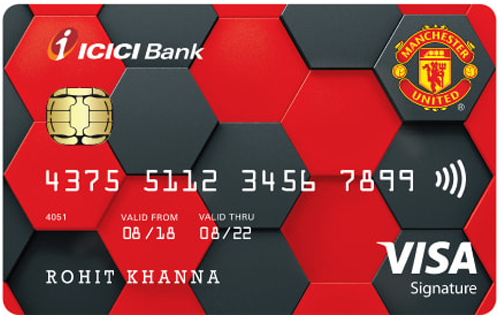

ICICI Manchester United Signature Credit Card has been launched by the ICICI bank in collaboration with Manchester United. This card comes with several benefits and privileges, which you shouldn’t miss if you are a Manchester United fan. You get a Manchester United football along with Manchester United branded duffle bag when you sign up for this card. You can earn up to 5 Reward Points on every Rs. 100 you spend and redeem these points against an array of categories and products. Not only this, but you also get 2 complimentary domestic lounge access per quarter on your Manchester United Signature credit card on the basis of your quarterly spends. The card gives an amazing opportunity to Top 18 spenders of the year as they get access to the ‘Manchester United Experience.’ Read below to know more details about the ICICI Manchester United Signature Credit card:

New Features

You get a spend-based waiver on an annual fee of Rs 2,499 plus applicable taxes if your annual spend is more than Rs 2,50,000 in the previous year.

3.67% per month (44% per annum)

Rs. 100

Rs 99 (plus applicable taxes) per redemption request from the product catalog Rs 25 (plus applicable taxes) on redemption for partner brands

Get up to 1% fuel surcharge waiver on all fuel transactions at HPCL pumps.

3.5% of the transaction amount

2.5% of the withdrawn amount subject to the minimum amount of Rs 300.

Get up to 25% discount on Movie Ticket booking with BookMyShow and INOX. You also get access to exclusive dining offers with ICICI Bank Culinary Treats Programme.

Complimentary domestic lounges access per quarter with ICICI Manchester United Signature credit card

N/A

You get 3 Reward points on domestic transactions, 4 Reward points on international transactions, and up to 5 Reward points on the Manchester United match days.

N/A

N/A

The ICICI Reward Points can be redeemed against a lot of options including gifts and cashback at a rate of 1 RP = Re. 0.25.

2 complimentary domestic lounges access per quarter on the spending Rs. 5,000 or more in the previous quarter.

N/A

No data available

No data available