Benefites of SBI Credit Card Total Benefits...

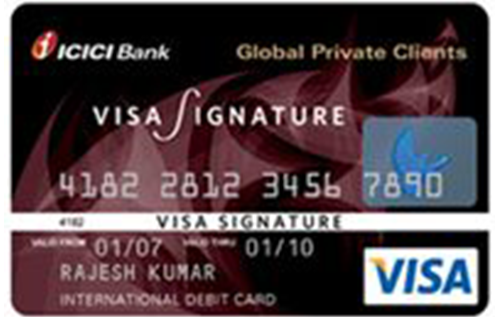

The ICICI Bank VISA Signature Credit Card is a card with unique and exclusive reward offers and benefits. It comes with a joining fee of Rs. 25,000 and provides you with a welcome benefit of 30,000 Hand-picked Rewards. Moreover, you get up to 10 Hand-Picked Rewards on every Rs. 100 you spend using this card. These Rewards can be redeemed against an array of options, including travel, dining, gadgets, Air miles, etc through the Hand-picked Rewards catalogue. You can also avail of a shopping voucher worth Rs. 1000 for every 1250 Hand-picked Rewards you earn. To give you a luxurious travel experience, the card gives you complimentary Priority Pass Membership that you can use to access over 600 domestic/international airport lounges worldwide. Other than all this, the ICICI Bank VISA Signature Credit Card has various exclusive benefits that can help you save a lot on all your purchases. To know all of them, keep reading the details given below:

New Features

N/A

3.4% per month (or 40.8% per annum)

Nil

Rs. 99 (plus applicable taxes) per redemption request

1% fuel surcharge waiver on all petrol pumps

3.5% of the transaction amount

2.5% of the amount withdrawn or Rs. 300 (whichever is higher)

N/A

Get complimentary Priority Pass Membership.

NA

On every spend of Rs. 100, you get 5 hand-picked rewards on international spends, 4 hand-picked rewards on travel bookings, 2 hand-picked rewards on hotels & restaurants, and 1 hand-picked reward elsewhere. 2X rewards on all categories for spends above Rs. 5 lakhs.

1 complimentary golf rounds each month on a total retail spend of over 1 lakh in the previous month

N/A

The Hand-picked Rewards you earn can be redeemed against various options like travel, fashion, dining, gadgets, shopping, InterMiles, etc.

NA

The cardholder will not be liable for any fraudulent transactions made on the card once the card is reported lost/stolen.

No data available

No data available