Benefites of SBI Credit Card Total Benefits...

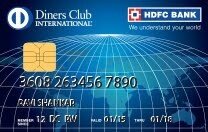

The HDFC Diners Club Black Credit Card offered by HDFC Bank offers users a fine dining experience. The credit card has an annual membership fee of Rs.10,000 plus taxes. The users of HDFC Diners Club Black Credit Card enjoy a ton of benefits that range from complimentary golf games to complimentary membership to various places.

New Features

Renewal fee waived off on spending Rs.1 lakh

3.6%

Nil

Rs 99 on every redemption request (plus applicable taxes)

5,000

3.%

500

N/A

You can use the Reward points to book hotel/flights bookings on Smartbuy.

N/A

3 RPs per Rs. 150 spent and 10x RPs on partner brands

N/A

N/A

For redemption against flight/hotel bookings on SmartBuy, 1 Reward Point = Rs. 0.30, 1 Reward Point = 0.30 Airmiles, 1 Reward Point = up to Rs. 0.25 for redemption against product catalogue, 1 Reward Point = Rs. 0.15 for redemption against cashback.

N/A

The cardholder will not be liable for any transactions done on the card once the card is reported lost/stolen to the bank.

Double reward points on grocery, airline, and dining spends 3 RPs per Rs. 150 spent and up to 3x reward points for spends at partner brands Complimentary 24×7 concierge service

No cashback earned on spends No complimentary airport lounge access with the card No complimentary movie ticket offers