Benefites of SBI Credit Card Total Benefits...

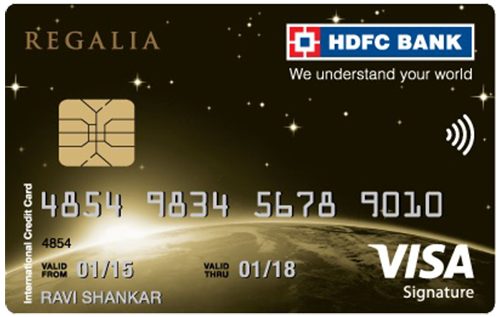

The HDFC Bank Doctor’s Regalia Credit Card, exclusively designed for doctors, has been made to complement the lifestyle of doctors, by providing attractive travel benefits and features that will be best suited for the doctors. You are rewarded with reward points not on retail spends but also on paying rent and utility bills. Apart from this, you are eligible to enjoy luxurious travel by gaining access to lavish airport lounges across the globe every year by using the Priority Pass. Considering the international travel needs of the doctors, this card offers a low Foreign Currency Markup fee of 2%. It is a Reward based card wherein you get 4 Reward Points on every Rs. 150 spend on retail purchases including payment of rent and utility bills. The membership fee of Doctor’s Regalia Credit Card is placed at Rs. 2,500 per annum. It provides you with the benefit of renewal fee waiver on the basis of amount you spend in the previous year. Keep reading the article to know more about the features and benefits that come along with this card.

New Features

NA

Earn 4 Reward Points on every Rs. 150 spent on all retail transactions

Reward points can easily be redeemed for hotel and flight bookings, premium products and vouchers through https://offers.smartbuy.hdfcbank.com/regalia

Nil

No data available