Benefites of SBI Credit Card Total Benefits...

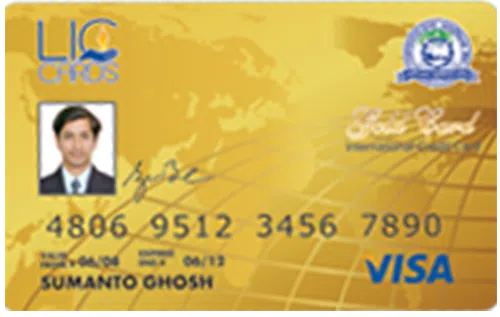

Life Insurance Corporation offers a LIC Gold EMV Credit Card to cater to the needs of first-time credit card users. With this card, you can enjoy insurance benefits and shopping benefits. You can get this credit card with no joining and renewal fee. Keep reading to know more about the LIC Gold EMV credit card’s features and benefits.

New Features

Nil

2.75% p.m. (33% p. a.)

NIL for the first and Rs. 100 is charged for every other additional add-on credit card.

Rs. 30 + GST

Avail 2.5% fuel surcharge waiver at all petrol pumps in India. Minimum of Rs. 10.

Foreign Currency Markup 3.50% on the conversion amount

Avail 2.5% fuel surcharge waiver at all petrol pumps in India. Minimum of Rs. 10.

N/A

N/A

N/A

You can earn 1 reward point on spending every Rs. 150 using this card. 1 RP = Rs. 0.25.

N/A

Covers personal accident insurance of up to Rs. 1 lakh and a credit shield of upto Rs. 50,000 in case of permanent disability with this credit card. You also get purchase protection of Rs. 50,000.

Reward points can be used for clearing credit card outstanding. They can also be redeemed towards home and lifestyle products as well as dining and shopping benefits A minimum of 1,000 reward points can be redeemed towards the credit card balance.

N/A

N/A

No data available

No data available