Benefites of SBI Credit Card Total Benefits...

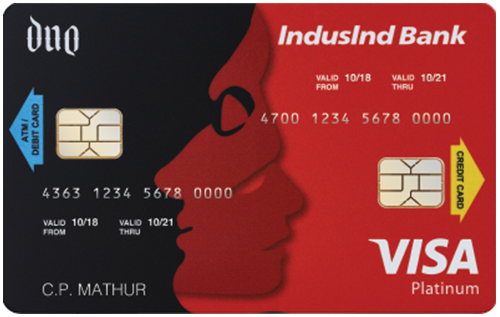

IndusInd InterMiles Voyage Visa credit card is a premium travel card that provides travel and lifestyle benefits. You get a 2,000 bonus InterMiles and a discount voucher of Rs. 750 on flight bookings and Rs. 1,500 on hotel bookings as a welcome benefit on this card. Furthermore, you also get 2,500 bonus InterMiles and a discount voucher of Rs. 500 on flight bookings and Rs. 1,000 on hotel bookings every year on renewal fee payment. With this credit card, you earn up to 3 intermiles on regular spends and 2x InterMiles on flight and hotel bookings on intermiles.com. This card does not only offers you travel benefits like a complimentary Priority Pass, but certain lifestyle benefits as well. You get 1+1 offers on movie ticket bookings on BookMyShow. There are several other benefits associated with this such as travel insurance, fuel surcharge waivers, concierge services, air accident cover, liability protection, auto assistance, etc. Read on to know more:

New Features

Nil

1% fuel surcharge waiver on all transactions between Rs. 400 to Rs. 4,000 across all fuel stations in India

Nil

2.5% on the withdrawal amount subject to a minimum charge of Rs. 300

3.83% per month ( 46% per annum)

Nil

1+1 offer on movie ticket bookings with BookMyShow.

Complimentary Priority Pass Membership & several travel insurance covers.

Complimentary air accident insurance cover upto Rs. 25 lakhs.

2 InterMiles per Rs. 100 spent on weekdays, 3 Intermiles per Rs. 100 spent on weekends & 2x InterMiles on flight/hotel bookings on intermiles.com.

1 complimentary golf game & 1 lesson every quarter.

Zero liability protection cover is provided if loss is reported within a stipulated period of 48 hours

InterMiles can be redeemed against flight and hotel bookings at www.intermiles.com and against shopping vouchers at rewardstore.intermiles.com.

N/A

NA

No data available

No data available