Benefites of SBI Credit Card Total Benefits...

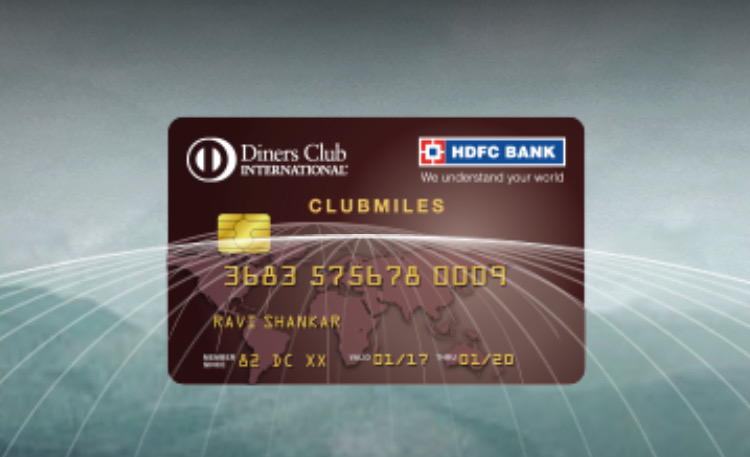

he Diners Club Miles Credit Card by HDFC Bank is among the most premium products offered by the bank. This credit card comes with some of the best-in-class features and benefits in the category of travel. Even though it is a travel credit card, the Diners Club Miles card also offers a wide range of benefits in the dining category as well. This credit card comes with an annual fee of Rs.1,000 and an interest rate of 3.49%.

New Features

Air accident Insurance up to Rs. 1 Crore, travel insurance cover worth up to Rs 50,000, emergency medical expenses cover worth up to Rs 25 Lakhs. Credit liability protection worth up to Rs 9 Lakhs.

3.6% per month (or 43.2% per annum)

Nil

Rs. 99 per redemption request (plus applicable taxes)

1% of Fuel Surcharge Waiver (waiver capped at Rs. 250 per billing cycle) at fuel stations all over India.

3.00% of the total transaction value (plus applicable taxes)

2.5% of the total transaction amount (Minimum Rs. 500)

15% discount and other offers on the finest restaurants all over India.

Complimentary access to domestic as well as international lounges.

Up to 6 complimentary access to international lounges annually.

4 Reward Points per Rs. 150 spent.

Complimentary access to domestic as well as international lounges.

Air accident Insurance up to Rs. 1 Crore, travel insurance cover worth up to Rs 50,000, emergency medical expenses cover worth up to Rs 25 Lakhs. Credit liability protection worth up to Rs 9 Lakhs.

1 Reward Points = 1 Airmile, 1 RP = Re. 0.50 when redeemed against flight or hotel bookings on SmartBuy, 1 RP = Re. 0.35 for products/vouchers, and 1 RP = Re. 0.20 for cashback.

Up to 6 complimentary access to domestic lounges annually

N/A

6 complimentary access to 700+ lounges worldwide annually Redeem Reward Points for bookings across 150+ airlines and a wide range of hotels Get air accident cover of Rs. 1 crore

No complimentary offers for movie tickets No Cashback on online spends No Golf Privileges