Benefites of SBI Credit Card Total Benefits...

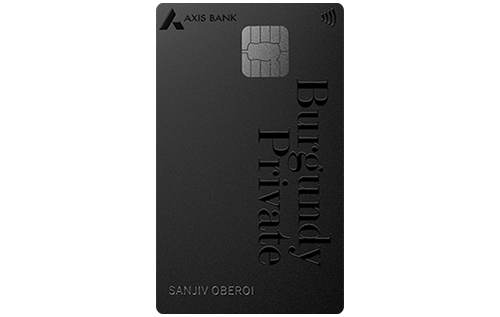

The Axis Bank Burgundy Private Credit Card, which comes with exclusively amazing rewards and benefits, targets high-income individuals and is absolutely free for people holding a Burgundy Private account. The card welcomes its customers with 30,000 bonus Reward Points and comes with an array of privileges across almost all the categories. The card is best suited for your needs; be it travel, entertainment, dining, or reward programs. With this, you earn 15 Reward Points on every Rs. 200 spent on your card, i.e, you are saving 1.5% every time you spend. Along with providing complimentary lounge access for primary as well as supplementary cardholders, the card gets you complimentary memberships to Club Marriott, Accor Plus, and Taj Epicure, in order to fill your luxurious lifestyle with even more luxury. Moreover, you get a complimentary Eazy Diner Prime membership and exclusive movie benefits as well. There are many more exciting benefits, such as golf privileges, insurance covers, etc, that the Axis Bank Burgundy Credit Card provides. Keep reading to know all of them:

New Features

NA

1.5% per month

Nil

Nil

Surcharge waiver of 1% on all transactions between Rs. 400 & Rs. 4,000.

0%

Nil

Complimentary Eazy Diner membership & Buy 1 Get 1 free offer on movies.

Complimentary access to international as well as domestic lounges.

Unlimited complimentary international lounge access.

15 Edge Reward Points for every Rs. 200 spent.

50 complimentary golf rounds every year.

Insurance cover worth Rs. 4.5 Crores in case of an air accident, travel insurance, lost card liability, and purchase protection.

The redemption of Edge Rewards can be done against an array of options on the Edge Rewards website at a rate of 1 Edge Reward Point = Re. 0.20.

Unlimited complimentary domestic lounge access.

In case of any unauthorized transaction that takes place through your card post you have reported the same to the bank, you will not be held liable.

No data available

No data available