Benefites of SBI Credit Card Total Benefits...

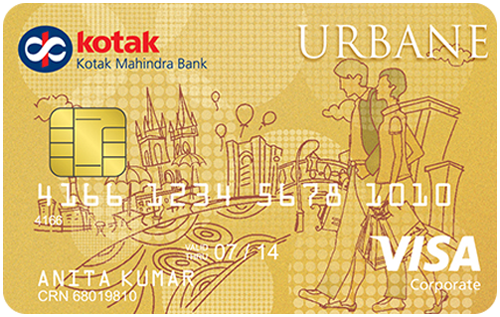

Issued by Kotak Mahindra Bank, Kotak Urbane Gold Credit Card is well designed to suit the needs of frequent shoppers as it offers rewards for all the purchases made. The card carries a very nominal fee of Rs. 199 and provides amazing benefits in comparison to the fee it charges. This card lets you earn 3x reward points per Rs. 100 spent on all retail spends. Additionally with this card you can get upto 4 PVR tickets or 10,000 rewards points upon spending Rs. 1 Lakh or more in a year. These movie tickets can be claimed any time, anywhere. And the reward points are redeemable against Airtickets, Movie Tickets, Mobile Recharge etc. Along with these privileges, this card provides a credit shield of Rs. 50,000 if the card is lost. To know more about the Urbane Gold card By Kotak Bank, keep reading the article below:

New Features

Get the annual fee waived on spending Rs. 15,000 in the previous year.

3.5% per month (or 42% annually)

Nil

Nil

NA

3.5% on all foreign transactions

Rs. 300 per Rs. 10,000 withdrawn

NA

NA

NA

3x Reward Points per Rs. 100 you spend on all retail transactions

NA

Insurance cover for a lost or stolen card

Redeem the earned points for various categories like Movie Tickets, Mobile Recharge, etc. Rewards Points can used to pay your shopping bills through PayByPoints Program

NA

Zero Liability Protection for a lost or stolen credit card upon reporting to the bank’s customer care.

No data available

No data available