Benefites of SBI Credit Card Total Benefits...

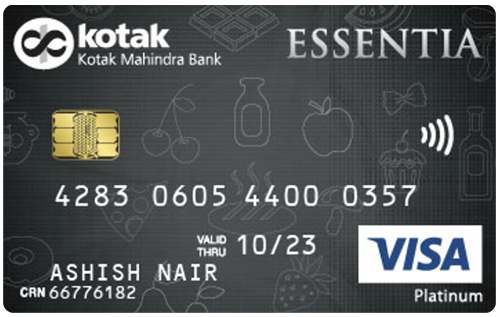

The Essentia Platinum card by Kotak Mahindra bank is one of the entry-level credit cards. Still, it can be very rewarding if it fits your spending habits and used the right way. There is no other credit card in the Indian market that is more rewarding as far as grocery and essential spends are concerned. If that is how you’re gonna use your card, just close your eyes and sign up for this Essentia Platinum credit card; you certainly can not go wrong with this one. The card gives you a 10% return on grocery spends as Saving Points which can be redeemed at Kotak Rewards portal or used as cash at partner merchants (one saving point is equivalent to Re. 1). Doesn’t it sound cool to earn Saving Points for grocery spends and redeem them for a flight ticket on your next vacation!

New Features

Nil

3.50% per month or 42% annually

Rs. 299/card

Nil

Applicable, subject to a minimum surcharge of Rs. 10

3.5% + GST

Rs. 300 per Rs. 10,000 (or part thereof) withdrawn.

6 movie tickets by PVR on the expenditure of Rs. 1,25,000 in 6 months.

NA

NA

10 Saving Points/Rs. 100 on purchases made at grocery and departmental stores and 1 Saving Point/Rs. 250 on all other spends

NA

Insurance cover worth Rs. 1.25 lakh against unauthorized transactions up to 7 days prior to reporting the loss of card.

Saving Points redeemable on Kotak Rewards portal for travel-related spends, shopping, mobile recharge, shopping vouchers and movie tickets. The Saving Points can also be used as cash (1 Point = Re. 1) at partner merchants.

NA

Cardholder not liable for any fraudulent transaction of up to Rs. 1,25,000 up to 7 days prior to reporting the loss of card.

No data available

No data available