Benefites of SBI Credit Card Total Benefits...

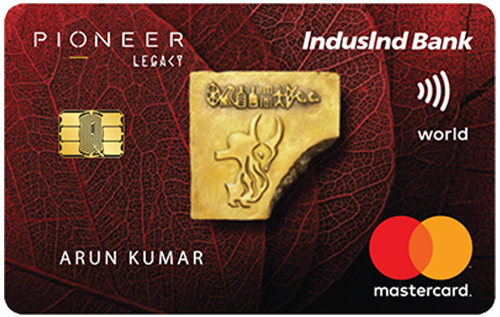

IndusInd Bank Pioneer Legacy credit card is a premium credit card issued by the IndusInd Bank, which comes in a paid and a free variant. Though the paid variant, with a joining fee of Rs. 45,000, provides you with several additional benefits, the free variant also has some exciting features including reward programs, 1+1 offers on movie tickets, etc. With this card, you earn 2 reward points on every Rs. 100 spent on weekends and 1 reward point on every Rs. 100 spent on weekdays. Redemption of the point accrued can be made against statement cash, Airmiles, or at Indus Moment’s reward portal. Besides that, you are provided with an Oberoi and a Luxe gift voucher as a welcome gift with the paid variant. You also get complimentary airport lounge access to domestic as well as international airport lounges and complimentary golf games & lessons at selected golf courses in India. To know more about the IndusInd Bank Pioneer Legacy Credit Card, keep reading:

New Features

NA

3.83% per month ( 46% per annum)

Nil

Rs. 100

1% surcharge waiver on fuel transactions made between Rs. 400 and Rs. 4,000

1.8% on all foreign currency transactions

Nil

Buy 1 Get 1 free offer on movie tickets on BookMyShow

Complimentary domestic as well as international lounge access and several travel insurance covers.

2 complimentary international lounge access every quarter with the Priority Pass.

Get 2 Reward Points on every Rs 100 spent on weekends and 1 Reward Point on every Rs 100 spent on weekdays.

4 complimentary golf games every month

Complimentary Air Accident cover worth Rs 25 lakhs.

1 RP = Re. 1 for redemption against cash credit and 1 RP = 1 InterMile / 1 CV Point for redemption against InterMiles or club Vistara points.

1 complimentary domestic lounge access every quarter

Get a liability protection cover on loss/theft of card if reported within 48 hours.

No data available

No data available