Benefites of SBI Credit Card Total Benefits...

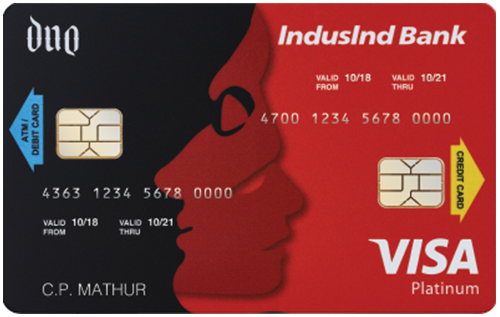

The IndusInd Bank Duo Plus Credit Card is one of India’s first credit cum debit cards that provides its customers with double benefits with a single card. The card comes with a nominal joining fee of Rs. 1,500 and gives you a welcome gift voucher worth Rs. 1,000 from any of the top brands like BATA, Levis, Pantaloons, Pizza Hut, etc. You earn Reward Points on almost all your spends with this card, which you can use against various products & offers at IndusMoments or even against cash credit. Moreover, on booking movie tickets on BookMyShow, you get 1 free movie ticket every time you book one ticket with this card. There are various other advantages of having an IndusInd Bank Duo Plus Credit Card. To know all of them, keep reading the detailed information given below:

New Features

NA

3.83% per month

Nil

Rs. 100

1% fuel surcharge is waived off for all transactions between Rs. 400 & Rs. 4,000

2% on all foreign currency spends

2.5% of the cash amount or Rs. 500 (whichever is higher)

But 1 get 1 free offer on movie tickets

NA

NA

1 Reward Points per spend of Rs. 150

NA

Insurance coverage against personal accidents and against a lost card is provided.

1 RP = Re. 0.75 for redemption on Indusmoments and 1 RP = Re. 0.75 for redemption against cash credit.

NA

The cardmember will not be liable for any fraudulent transactions made on his/her card after reporting the loss to the bank.

No data available

No data available