Benefites of SBI Credit Card Total Benefits...

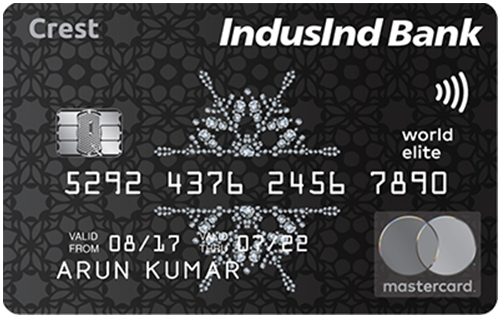

Crest credit card by IndusInd bank is a top-end offering that comes packed with many premium benefits, including a 24×7 concierge service, personal air accident cover, complimentary LoungeKey membership, and multiple best-in-class privileges that one expects from a premium credit card. The Crest card is very similar to IndusInd Bank’s own Indulge Credit Card (we’ve already covered the Indulge card in our earlier posts). That being said, the Crest credit card offers a few additional travel benefits. Not only lounge access, but it comes with various other premium advantages, such as complimentary stays at Oberoi hotels, special airport services, etc. Coming to its entertainment benefits, one can avail of complimentary movie tickets (3 per month) by booking through BookMyShow. Making your dining experiences more rewarding, it provides you with Club ITC Culinaire membership and up to 25% savings on your dining bills. To know more about this card, keep reading.

New Features

Annual membership fee waived off on spending Rs. 20,00,000 in the previous year

2.99% per month (or 36% annually)

Rs. 10,000

Rs. 100

Waived for transactions between Rs. 400 and Rs. 4,000

3.5% + GST

2.5% of the advanced amount, subject to a minimum amount of Rs. 300

Buy One Get One ticket offers on BookMyShow (max 3 free tickets per month), exclusive dining benefits with Club ITC Culinaire membership.

LoungeKey membership with complimentary lounge access per quarter, and complimentary access to domestic lounges under the MasterCard India lounge access program.

2 complimentary international lounge visits every quarter with the LoungeKey membership

0.70 Reward Points per Rs. 100 on international & domestic spends

3 complimentary golf rounds and golf lessons every month with the exclusive golf program and 12 complimentary golf lessons & golf games every year with the Mastercard Golf program.

Personal air-accident cover worth Rs. 2.5 crores, lost card liability protection from 48 hours prior to the time of reporting the loss of card.

1 RP = Rs.0.75 for redeeming against cash credit and 1 RP = 1 AirMile when redeeming against partner airlines’ airmiles.

2 complimentary domestic lounge visits quarterly under the MasterCard Lounge access program.

Zero cost liability protection from 48 hours prior to reporting the loss of card.

No data available

No data available