Benefites of SBI Credit Card Total Benefits...

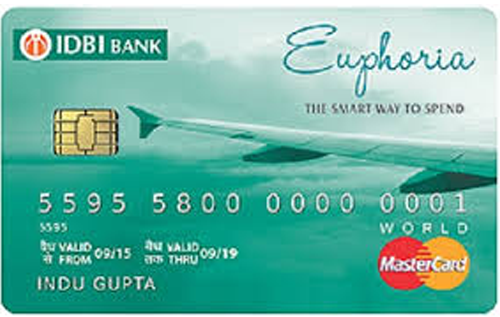

The IDBI Euphoria World Credit Card is a basic card issued by the IDBI Bank with an aim to provide maximum benefits to its customers with minimum charges. It comes with zero joining fee and rewards you in the form of Delight Points. The card welcomes you with a bonus of 4,000 Delight Points on making an eligible transaction. You get 3 Delight Points every time you spend Rs. 100, and 2X Delight Points on spending for flight/hotel/bus bookings, IRCTC, etc. The Delight Points are redeemable against various categories including travel, entertainment, cash, etc. Moreover, to give you a luxurious travel experience, the card provides complimentary airport lounge access at several participating lounges in India. There are several other advantages of the IDBI Euphoria World Credit Card that include spend-based annual fee waiver, fuel surcharge waiver, exclusive insurance benefits, and many more. To know all about the card and its fees & charges, refer to the information given below:

New Features

The renewal fee is waived off if you spend Rs. 1,50,000 or more in the previous year.

2.9% per month

Nil

Rs. 99

1% fuel surcharge waiver for all transactions between Rs. 400 & Rs. 5,000.

3.5% on all foreign currency transactions

2.5% of the cash withdrawn or Rs. 500 (whichever is higher)

NA

Complimentary airport lounge access

NA

3 Reward Points per Rs. 100 spent & 6 Reward Points per Rs. 100 spent on hotels, Airlines, Bus bookings, etc. You can save up to 1.5% using this card.

NA

You get an air accident insurance coverage worth Rs. 25 lakhs.

1 Delight Point = Rs. 0.25.

Complimentary domestic lounge access to selected lounges in India.

The cardholder will not be liable for any misuse of a card once the card is reported lost/stolen to the bank.

No data available

No data available