Benefites of SBI Credit Card Total Benefits...

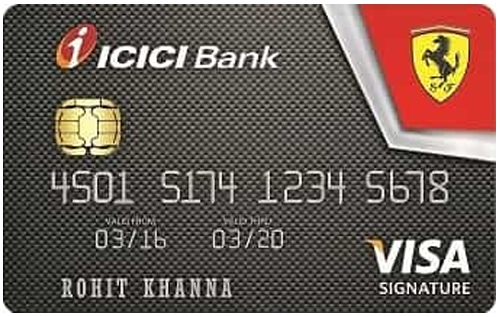

The ICICI Bank Ferrari Signature Credit Card is a co-branded credit card issued by the bank in partnership with Ferrari. It is specially made for individuals who are Ferrari fans in order to provide them with exclusive Ferrari privileges. The cardholders can avail of a 20% discount on Ferrari merchandise and top spenders get exclusive privileges, including a trip to the home of Ferrari in Italy. Moreover, you earn 2 Reward Points on every Rs. 100 you spend using this card and redeem these points against several categories & products of your choice. Other than all these reward offers, the card comes with exciting travel and entertainment benefits as well. You can avail of up to 2 complimentary movie tickets every month, 2 complimentary domestic lounge access every quarter, and make your experiences even more rewarding. Moreover, additional benefits of this card include a spend-based annual fee waiver, fuel surcharge waiver, etc. To get full details about the features of te ICICI Bank Ferrari Signature Credit card, keep reading:

New Features

The annual fee is waived off on spending Rs. 2,50,000 or more in the previous year.

3.40%

Nil

Rs. 99 on every redemption request.

1% fuel surcharge waiver at all HPCL fuel stations.

3.5% on all overseas transactions.

2.5% of the transacted amount subject to a minimum of Rs. 300.

Buy 1 Get 1 Free offer on movies on BookMyShow & a minimum discount of 15% on dining.

Complimentary domestic lounge access every quarter.

NA

2 Reward Points on every Rs. 100 you spend.

NA

NA

The Reward Points you earn can be redeemed against an array of categories at a rate of 1 Reward Point = Re. 0.25.

2 complimentary domestic lounge access each calendar quarter.

The cardholder will not be liable for any unauthorized transactions made on the card if the card is reported lost/stolen to the bank in a timely manner.

No data available

No data available