Benefites of SBI Credit Card Total Benefits...

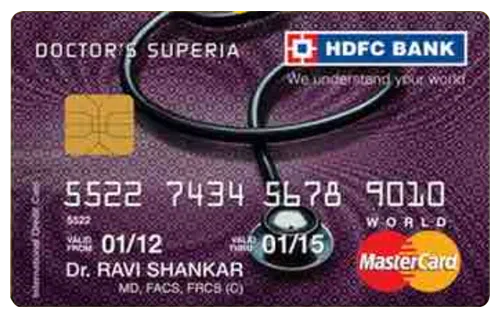

The HDFC Bank Doctor’s Superia Credit Card is a reward-based card that is exclusively designed to complement the hectic life of doctors. You can earn accelerated reward points with this card. Cardholders who travel often can benefit immensely from this credit card as the reward points can be converted into AirMiles and can be further redeemed to book flight tickets from over 20 international airlines or any major domestic airline. An eligible applicant can own this card after submitting a joining fee of Rs. 1,000 and the card is renewable at a fee of Rs. 1,000 per annum which can be waived off on the basis of your spendings. This card also offers special dining benefits so that doctors can enjoy extra reward points while dining out and paying through this card. HDFC Bank Doctor’s Superia Credit Card also provides you insurance cover worth up to Rs. 20 Lakhs which secures them in cases of unfortunate events. Apart from these benefits, there are further fees and rewards associated with this card which you can learn more about below :

New Features

Spend Rs. 1 Lakh in a year and get waiver of next year's annual membership fee

3.6% per month (43.2% per annum)

Nil

N/A

Get 1% fuel surcharge on transactions between Rs. 400 and Rs. 5000 (max waiver capped at Rs. 250 per statement cycle)

3.5% on all international transactions

2.5% of the amount withdrawn (subject to a minimum of Rs. 500)

Enjoy 50% more reward points every time you dine out at a restaurant.

N/A

N/A

Earn 3 reward points on spend of every Rs.150

N/A

Get Professional Indemnity Insurance coverage worth up to Rs.20 Lakhs.

The earned points can be redeemed to get AirMiles where 667 Reward Points = 100 AirMiles. The reward points can also be redeemed for exclusive gifts listed in the reward catalog.

N/A

The cardholder shall not be liable for any fraudulent transaction made with the card post reporting the loss of card to the bank.

– The Card has an affordable annual fee of Rs. 1,000 only. – Bonus Points are offered not just in the first year, but every year on card renewal. – Accelerated reward points are offered on dining spends. – No add-on fee is there for supplementary cards.

– There is no free airport lounge access. – The reward Points conversion rate to Airmiles is too low, i.e, 667 Reward Points = 100 AirMiles.