Benefites of SBI Credit Card Total Benefits...

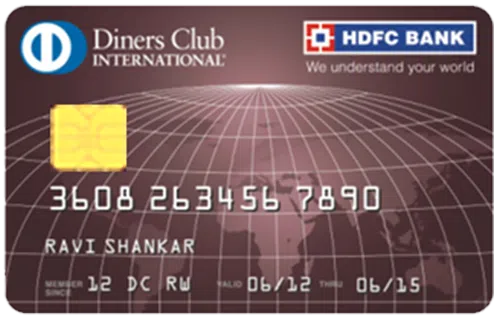

As suggested by the name, the HDFC Diners Club Premium Credit Card is a premium card issued by the HDFC Bank with exciting reward offers and travel benefits. The bank provides the card with a joining fee of Rs. 2,500 and a welcome benefit of 2,500 Reward Points. With this card, you get 4 Reward Points on every spend of Rs. 150 on retail purchases. These reward points can be redeemed against Air tickets/Hotel bookings, Air Miles, Product Catalogue, & Cashback. Hence, you get an opportunity to save on all these expenses by using your earned Reward Points. With a renewal fee of Rs. 2,500 only, the card has various exclusive benefits, such as complimentary airport lounge access every calendar year. The renewal fee can also be waived off if you spend Rs. 3 lakhs or more in the previous year. There are several other advantages of this card, such as insurance benefits across a variety of categories, zero liability protection, fuel surcharge waiver, etc. To know all about the HDFC Diners Premium Credit Card, its benefits, and fees & charges in detail, keep reading the information given below:

New Features

Renewal fee waived off for this card on spending over Rs. 3 lakhs within one anniversary year

3.6% per month (or 43.2% annually)

Nil

Rs. 99 (plus applicable taxes)

1% fuel surcharge waived off on all fuel transactions between Rs. 400 to Rs. 5,000

2% on all foreign currency transactions (plus applicable taxes)

2.5% of the cash amount withdrawn or Rs. 500 (whichever is higher)

N/A

6 Complimentary lounge access at more than 1,000 airports lounges globally

Up to 6 international airport lounge access every year

4 Reward Points on every retail spend of Rs. 150. Savings of up to 1.3% on all your spends through this card

N/A

Insurance cover of Rs. 1 Crore for an air accident, coverage worth Rs. 25 lakhs for emergency hospitalization, and a cover worth Rs. 50,000 for baggage delay

You can redeem reward points against air tickets, and for AirMiles across Singapore Airlines, Air India, and Jet Airways at a rate of 1 RP = 0.50 Air Miles. 1 RP = Rs. 0.50 for redemption against Flight/Hotel bookings through Smartbuy, 1 RP = up to Rs. 0.35 for redemption against products & vouchers, and 1 RP = Rs. 0.20 for CashBack

Up to 6 domestic airport lounge access every year

The cardholder will not be liable for any fraudulent transaction done through his/her lost/stolen credit card if reported to the bank within 24 hours of the loss

Get 6 complimentary access to more than 1000 lounges worldwide Renewal fee waiver on spending Rs. 3 Lakhs in the year Cross-currency conversion charges are low and 2% forex markup fee

No complimentary movie ticket, entertainment, and dining offers No cashback on your spends made with the card Reward rate could have been a bit better