Benefites of SBI Credit Card Total Benefits...

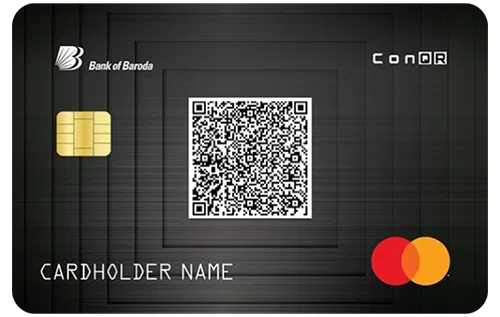

Along with offering several personal credit cards in different categories, BoB Financial also has business credit cards in its portfolio. One such card is the Bank of Baroda ConQR Credit Card which is solely aimed at providing business owners with maximum rewards and benefits with no additional charges. It is a lifetime free credit card and comes with a decent reward across different categories. You get up to 5 Reward Points on every spend of Rs. 100 and these rewards are redeemable against a variety of options available at the BoB Rewards portal. Moreover, the card offers exciting deals and discounts on flight & hotel bookings. Other benefits of this card include insurance covers against personal accidental death, 1% fuel surcharge waiver, zero liability protection against a lot/stolen card, and many more. To know more about the Bank of Baroda ConQR Credit Card and all its features, keep reading the article:

New Features

N/A

3.25% per month

Nil

Nil

1% fuel surcharge waiver on all fuel transactions between Rs. 400 and Rs. 5,000. The maximum waiver per month is capped at Rs. 250.

3.50% of the total conversion amount

2.5% of the withdrawn amount or Rs. 300 (at domestic ATMs), and 3% of the withdrawn amount or Rs. 300 (at international ATMs)

N/A

Get up to Rs. 800 discount on flight bookings and great discounts on hotel bookings at Fab hotels, Vista rooms, and Treebo hotels.

N/A

Get 1 Reward Point on every retail spend of Rs. 100 and 5 Reward Points on every Rs. 100 spent on dining, utility bills, and online purchases.

N/A

Get a personal air accident cover worth Rs. 15 lakhs and a non-air accident cover worth Rs. 5 lakhs.

The reward points earned using this credit card can be redeemed against lots of options available at the BoB Rewards portal. 1 Reward Point = Re.0.25.

N/A

The cardholders will not be liable for any fraudulent/unauthorized transactions made on a lost/stolen card if the loss is reported to the bank in a timely manner.

No data available

No data available