Benefites of SBI Credit Card Total Benefits...

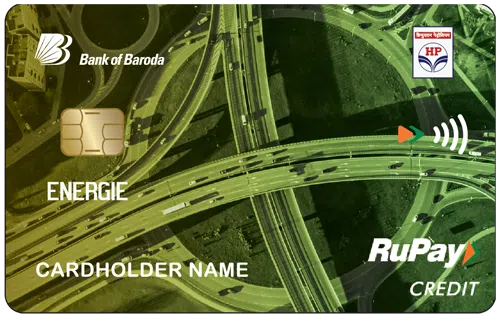

Together with the Hindustan Petroleum Corporation Limited (HPCL), the Bank of Baroda recently launched a co-branded credit card – HPCL Bank of Baroda ENERGIE Credit Card. This credit card has been designed keeping in mind the hike in fuel prices. But even after the hike, fuel is an individual’s necessity but what better than being rewarded for the amount that you spend on your fuel purchases. There exists another HPCL co-branded credit card in the market which is the ICICI Bank HPCL Super Saver Credit Card. Both these cards are in direct competition with each other. The HPCL Bank of Baroda ENERGIE Credit Card comes with a joining and renewal fee of Rs. 499 which is quite genuine with respect to the rewards that this card offers to its holders. You can earn up to 24 Reward Points for every Rs. 150 spent on fuel purchases at the HPCL fuel stations. You are also entitled to a welcome benefit of 2,000 Reward Points with this credit card. There are various other benefits that cardholders will receive. Keep reading the article to know more about this credit card –

New Features

Get renewal fee waived off on spending Rs. 50,000 or more in the preceding year.

3.49% pm (or 41.88% annually)

Nil

Nil

1% at all fuel stations in India

3.5% on all foreign transactions

2.5% of the amount or Rs. 500, which ever is higher.

25% off on the purchase of 2 movie tickets via Paytm movies

Complimentary visits to airport lounges.

N/A

Get 24 Reward Points per Rs. 150 spent on fuel transactions at all the HPCL fuel stations.10 Reward Points per Rs. 150 spent on groceries and departmental spends.2 Reward Points per Rs. 150 spent on other categories.

N/A

N/A

the reward Points earned are redeemable for various options available on the BoB website and can be redeemed for cash as well. 1 RP = Rs. 0.25

4 Complimentary access to domestic lounges annually (1 visit every quarter)

Zero Liability Protection to the cardholder if the card is reported lost or stolen in a timely manner.

No data available

No data available