Benefites of SBI Credit Card Total Benefits...

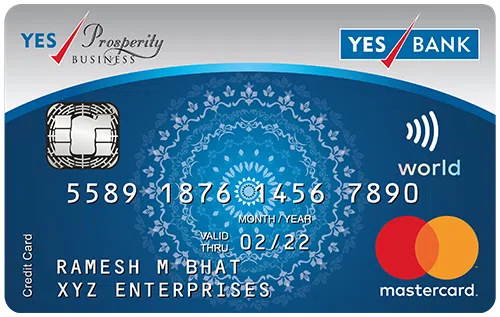

YES PROSPERITY Business Credit Card is the second business card launched after YES FIRST Business Credit Card to assist businesses. The Prosperity Business has similar features to the First business card but in a limited manner. The Prosperity card offers reward points on all business transactions categorized under the select categories and all categories. The card offers benefits in many sectors like travel, fuel, lifestyle, and many more. The prosperity card offers great milestone benefits, spend-based waiver benefits, and other benefits like fuel surcharge wavier for businesses, and most importantly the card charges only 2.5% towards the foreign currency markup on all international transactions. This rate is very low when compared to other business cards. Certain travel benefits like complimentary access to domestic as well as international airport lounges are also provided to make business travel lavish. Along with that, a golf program is also provided. The great part is, that all these benefits and privileges associated with the card are just offered at the Annual fee of just Rs. 399. Following is a detailed review of the card:

New Features

Spend Rs. 25,000 within first 90 days from card activation and get 1st year membership waived off and Spend Rs 1,00,000 in card anniversary year and get waiver on renewal fee for the subsequent year.

3.50% per month (42% p.a.)

Nil

Rs. 100

1% fuel surcharge waiver valid for transactions between Rs. 400 to Rs. 5000 only. Maximum surcharge waiver in a statement cycle is Rs 500.

2.5% of the transaction amount.

2.5% (subject to a minimum charge of Rs. 300)

N/A

Complimentary domestic as well as international airport lounge access.

3 complimentary international Lounge access (per year) at airports outside India

4 Reward Points for every Rs. 200 spent on all categories (except select categories) 2 Reward Points for every spent Rs. 200 on Select categories.

1 complimentary golf lesson every calendar month and Waiver of green fee at select golf courses (Only for VISA Cardholders)

Air Accidental Insurance, Medical Insurance Cover and Accidental death cover.

Redeem points for Flight/Hotel/Movie ticket booking, Exclusive Catalogue of Products or against Air Miles (8 Reward Points = 1 InterMile / 1 Club Vistara Point) on YesRewards.

1 complimentary Domestic Lounge access per quarter (Only for VISA Cardholders)

Cardholder not liable for any fraudulent transaction post the time of reporting the loss to Yes Bank’s customer care.

No data available

No data available