Benefites of SBI Credit Card Total Benefits...

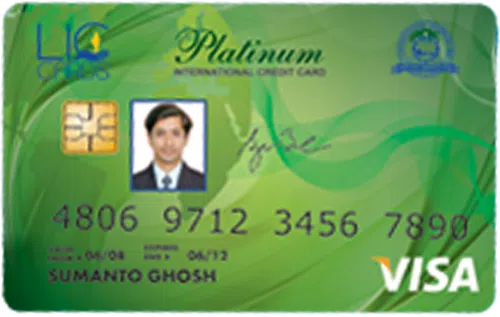

LIC Platinum EMV Credit Card is a co-branded Visa card launched in collaboration with the Corporation Bank. The card comes with an in-built EMV feature to enhance security. This card charges zero annual fees from its customers on sign-up. In addition to this, the customers get 1 reward point on every Rs 150 spent using this card. The card offers a host of benefits to its customer’s such as accidental protection cover, credit liability, fuel surcharge waiver, and EMI facility. Read below to know more about the LIC Platinum EMV card’s features and offers.

New Features

N/A

3% per annum

Nil

Rs 30 per redemption request

2.5% fuel surcharge waiver on all fuel transactions across all petrol pumps

N/A

2.5% on the withdrawal amount subject to the minimum amount of Rs 200.

N/A

N/A

N/A

1 Reward Points on every Rs 150 spent on all categories ( 1 Reward Point = Rs 0.50)

N/A

You get a personal accident insurance cover and credit liability cover of Rs 50,000. You get purchase protection cover of Rs 50,000.

You can redeem these reward points against the statement cash of your outstanding amount.

N/A

Protection cover is provided to customers if the fraudulent transaction or any unauthorized transaction is reported within 24 hours to the bank.

No data available

No data available