Benefites of SBI Credit Card Total Benefits...

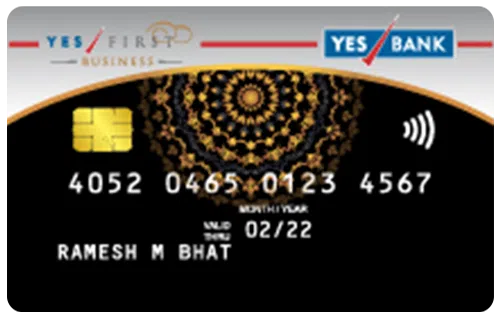

YES FIRST Business Credit Card by the Yes bank has been designed to deliver the best privileges to businesses with tons of benefits. The YES bank has launched two business cards till now which are, YES FIRST Business Credit Card and YES PROSPERITY Business Credit Card. The card delivers exciting Reward Points for all business transactions and benefits in travel, fuel, and redemption options across various categories including Air Travel, Hotel Stays, accessories, and more. The First Business card offers tons of reward points on all categories as well as on select categories. Apart from that, the card provides great milestone benefits, a fuel surcharge waiver, and spend based fee waiver. The best part is that the Foreign Currency Markup on the card is 1.75% only. This is a very low rate as compared to other cards. Also, the card offers great travel benefits like complimentary international lounge access with the Priority Pass Membership for Mastercard cardholders and LoungeKey Program for VISA Cardholders. Along with international access, the card also offers domestic lounge access for VISA cardholders. On top of that, 1 complimentary lesson is also offered with the First Business card. Refer to the followings details, to get a more thorough review of the card:

New Features

Get joining fee waived on spending Rs. 60,000 in first ninety days and also get the annual fee waived on spending Rs. 3,00,000 in a year.

3.50% per month (42% p.a.)

Nil

Rs. 100

1% fuel surcharge waiver on transactions between Rs. 400 to Rs. 5000. (capped at Rs 1,000 per month).

1.75% on the international transaction.

2.5% (subject to a minimum charge of Rs. 300)

8 Reward Points per Rs. 200 you spend on all categories, 4 Reward Points per Rs. 200 spent on Select categories.

Reward points can be redeemed against Flight/Hotel/Movie bookings, against Air Miles (8 RPs = 1 InterMile or 1 CV Point), or an Exclusive Catalogue of Products.

6 complimentary access to international lounges.

8 Reward Points per Rs. 200 you spend on all categories, 4 Reward Points per Rs. 200 spent on Select categories.

1 complimentary golf lesson per month and green fee waiver at select golf courses (Only for VISA Cardholders)

Insurance Cover up to Rs. 1 crore.

Reward points can be redeemed against Flight/Hotel/Movie bookings, against Air Miles (8 RPs = 1 InterMile or 1 CV Point), or an Exclusive Catalogue of Products.

2 complimentary access to Domestic Lounges quarterly (for VISA Cardholders).

The cardholder will not be held liable for any unauthorized transaction done on the card once the card is reported lost or stolen to the bank.

No data available

No data available