Benefites of SBI Credit Card Total Benefits...

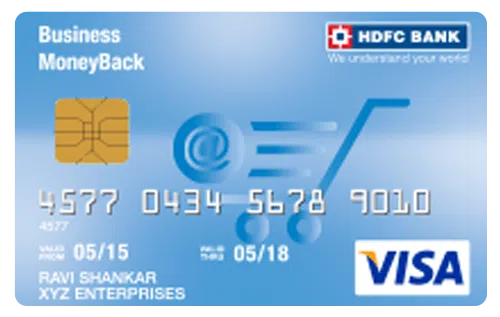

HDFC Business Moneyback Credit Card is a business card offered by HDFC bank with a low annual fee. The card is made for all types of business transactions where the users can receive both reward points as well as cashback on their transactions. The HDFC Bank also offers the standard MoneyBack Plus Credit Card, which can be considered the non-corporate version of this Business MoneyBack Card. The HDFC Business Moneyback Credit Card charges Rs 500 as joining fees and the annual renewal charges. The card offers great reward points like 4 Reward Points on every Rs 150 spent online and 2 Reward Points on every other spend. Also, the card offers 5% Cashback on Telecom, Utility, Govt & Tax Payments. The rewards are spending-based, the more you spend, the more rewards you earn. The card also offers other benefits like, Zero Lost card liability, Fuel Surcharge Waiver, Dining Benefit, Annual Spend Based Benefit, Contactless Payment, and much more. The HDFC Business Moneyback Credit Card is a great deal for Small Medium Enterprises (SMEs) as it offers No-Cost EMI options where they can buy furniture, spend in bulk and do big business transactions. Keep reading for a detailed review of this credit card:

New Features

Spend Rs. 50,000 in a year and get a waiver of next year's annual membership fee.

3.6% per month (43.2% per annum)

Nil

Rs. 99 per redemption request (plus applicable taxes)

1% fuel surcharge waived off for all transactions between Rs. 400 & Rs. 5,000 and Maximum Cashback of ₹250 per statement cycle.

3.5% per currency conversion (plus applicable taxes)

2.5% of the withdrawal amount subject to a minimum charge of Rs 500

Save upto 20% on dining bills paid through dineoutPAY

N/A

N/A

4 Reward Points on every Rs 150 spent online and 2 Reward Points on every other spent

N/A

N/A

Accumulated Reward Points can be redeemed for CashBack (100 Reward Points = Rs. 20) Reward Points can be also redeemed for exciting gifts and air miles from an exclusive rewards catalogue, at the applicable redemption rate.

N/A

Zero Liability Protection cover is provided by the HDFC bank against fraudulent transactions on your credit card if the loss is reported immediately within a stipulated time to the 24-hour HDFC Customer helpline,

No data available

No data available