Benefites of SBI Credit Card Total Benefits...

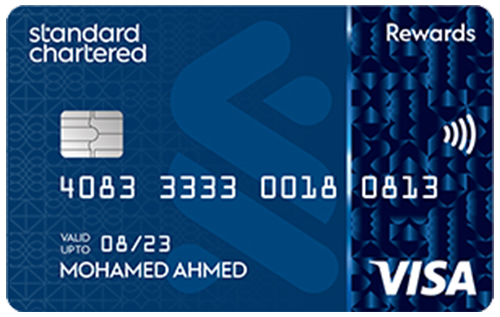

Standard Chartered has recently launched the exclusive Rewards Credit Card, which is targeted at those who prefer making most of their retail purchases using their credit card. The card comes with a zero joining fee and a renewal fee of Rs. 1,000, which can be waived on the basis of your total annual spends in the previous year. Talking about the reward rates of this card, it provides you with an amazing opportunity to earn up to 4x Reward Points on your spends. Moreover, you earn additional 4x Rewards after achieving the monthly spending milestone. Apart from its reward benefits, the card has exciting privileges across other categories as well. You get free lounge access to selected domestic airport lounges and various other benefits. To know more about the Standard Chartered Rewards Credit Card, its features, and fees & charges, keep reading:

New Features

The renewal fee is waived on spending Rs. 3 lakhs or more in the previous year.

3.75% per month

Nil

Rs. 99

1% fuel surcharge waiver on all fuel transactions

3.5% of the transaction amount

3% of the withdrawn amount subject to a minimum of Rs. 300

NA

Complimentary domestic lounge access every quarter.

NA

4 Reward Points on every retail spend of Rs. 150, 1 RP on every Rs. 150 spent on government payments and insurance.

NA

NA

1 RP = Re 0.25 for redemption against the Rewards catalog and 1 RP = Re. 0.20 for redemption against the card’s statement balance.

1 free domestic lounge access every quarter, i.e. 4 per year.

The cardholders are not liable for any fraudulent transactions made against a lost/stolen card if reported to the bank in a timely manner.

No data available

No data available