Benefites of SBI Credit Card Total Benefits...

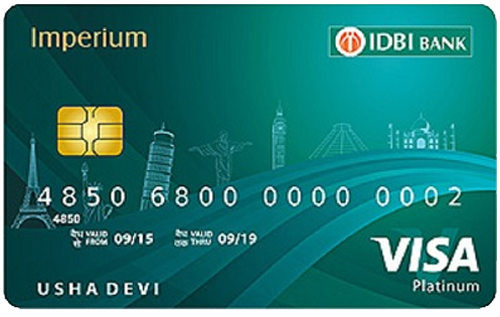

IDBI Bank Imperium Platinum credit card is a visa-powered secured credit card offered by IDBI Bank. IDBI Bank Imperium Platinum credit card comes with a sign-up bonus of 500 Delight points on every Rs 1500 spent within 30 days of card issuance and 300 Delight points on spending between 31 – 90 days of card issuance. Furthermore, you get up to 2 Delight points on every Rs 150 spent on shopping, traveling, and movies using your IDBI Bank Imperium Platinum credit card. Read below to know more in detail about IDBI Imperium Platinum credit cards.

New Features

NA

2.9% per month

Nil

Rs 100 per redemption request

As Applicable

3.5% of the conversion amount

2.5% on the withdrawal amount subject to a minimum charge of Rs 500

NA

NA

NA

2 Delight Points on every Rs 150 spent

NA

NA

1 Reward Point = Rs 0.25 redeemable on IDBI Delight reward portal at www.idbidelight.com or Max Get More merchant outlets.

NA

You get a protection liability cover in case of loss or theft, if reported within stipulated period of 24 hours at their customer helpline number.

No data available

No data available