Benefites of SBI Credit Card Total Benefits...

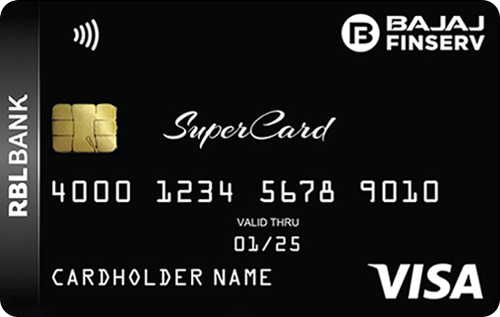

Bajaj Finserv launched the SuperCard in March 2019 and there have been more than 1 million customers in India, with most of them being first-time cardholders. Bajaj Finserv and RBL Bank collaborated on more than 16 variants of the SuperCard, and the Bajaj Finserv RBL Bank Binge SuperCard is currently available first year free for customers with an annual fee of Rs. 999 plus taxes from the second year onwards. For those who don’t have the first-year free version of the card, they can get a welcome benefit of 4000 reward points on spending Rs. 2000 within 30 days of getting the card. The card also has a decent reward rate offering 12 reward points per Rs. 100 spent online and on the Bajaj Finserv app, and 1 reward point on other offline spends. Other features on the card include emergency cash advance, 1+1 on BookMyShow movie tickets, domestic lounge access, fuel surcharge waiver, and more. There are also several pre-approved offers you can claim when you get this card. Read on to know more about the Bajaj Finserv RBL Bank Binge SuperCard

New Features

Renewal fee waiver on spending Rs. 1 Lakh or above in the card anniversary year

3.99% per month or 47.88% per annum

Nil

Rs. 99 per redemption request made on the card

1% fuel surcharge waiver or Rs. 10, whichever is higher

3.5% of the transaction amount plus taxes

2.5% of the withdrawn or a minimum of Rs. 500

Get 1 movie ticket free per month through BookMyShow

Get complimentary domestic lounge access with the card

NA

Earn 12 reward points per Rs. 100 spent on clothing, gadgets, home appliances, etc.

NA

NA

The reward points can be redeemed against various categories like shopping, travel, mobile recharge, etc.

Get 2 complimentary domestic lounge access per year

The cardholder is not liable for fraudulent transactions made with the card in case of timely reporting to the bank regarding theft or losing of the card

No data available

No data available