Benefites of SBI Credit Card Total Benefits...

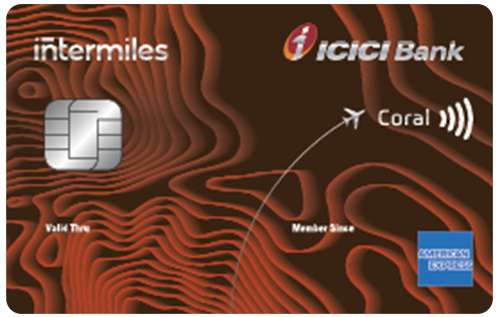

InterMiles ICICI Bank Coral Credit Card is a co-branded credit card that is issued by the bank in partnership with intermiles.com. Best suited for travel, this card rewards its customers in the form of InterMiles. You can earn up to 7.5 InterMiles on every Rs. 100 you spend with this card. With a joining fee of Rs. 1,250, the card welcomes you with 2,500 bonus InterMiles and travel-related vouchers worth Rs. 750. Along with the InterMiles, you also get exclusive complimentary airport lounge access every quarter. The benefits of this card are not only limited to travel, but you also get exciting discount offers on movies and dining. Other than all this, there are several exclusive features of the card that you must know. Keep reading to get all the details about the card:

New Features

N/A

3.4% per month (40.8% per annum)

Nil

Rs 99 (plus applicable taxes) per redemption request

Avail waiver of 1% fuel surcharge on the purchase of fuel up to Rs 4000 from HPCL pumps when swiping on ICICI Bank machines.

3.5% of transaction amount

2.5% ( subject to a minimum of Rs. 300)

25% discount up to Rs. 100 on purchase of movie tickets twice a month from BookMyShow, exclusive and exciting benefits on dining under ICICI Bank Culinary Treats Program.

Complimentary domestic lounge access.

N/A

3 Intermiles on Rs. 100 spent on the American Express variant and 2 Intermiles per Rs. 100 spent on the VISA variant, 6 InterMiles on every Rs. 100 spent on booking revenue airline tickets at intermiles.com on American Express variant and 5 InterMiles per Rs. 100 on VISA variant.

N/A

N/A

The accumulated InterMiles can be further redeemed for booking flights and hotels through www.intermiles.com, for purchasing gift vouchers, fuel, etc. 4 InterMiles are equivalent to Re. 1 (only applicable for fuel purchase).

You get 2 complimentary access to domestic lounges per quarter ( 1 each on VISA and American Express Variant).

N/A

No data available

No data available