Benefites of SBI Credit Card Total Benefits...

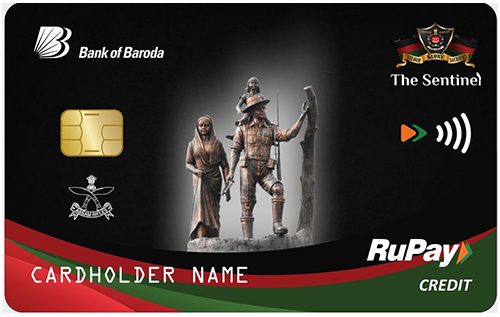

The Bank of Baroda Sentinel Credit Card is exclusively for the Assam Rifles personnel. In terms of features and benefits, this card is very similar to the Indian Army Yoddha Credit Card issued by Bank of Baroda. The Sentinel Card comes with a zero annual membership fee and provides you with several exciting privileges across different categories. You get a reward rate of up to 10 Reward Points on every Rs. 100 you spends and these Rewards can be redeemed against a number of options available on the BoB Rewards portal. To give a great start to your joirney with this card, it welcomes you with great benefits, such as complumentary Fitpass Pro membership, bonus Reward Points, and free zomato Po membership. Taking about its travel benefits, you get complimentary access to several domestic airport lounges in India every year. Other than this, you get free golf rounds, fuel surcharge waiver, and many more benefits that are discussed in detail in this article:

New Features

NA

3.49% per month.

Nil

Nil

1% fuel surcharge waiver on all fuel transactions between Rs. 400 and Rs. 5,000.

3.5% of the total transaction amount

2.5% of the withdrawn amount or a minimum of Rs. 300 at domestic ATMs and 3% or Rs. 300 at international ATMs

NA

Get free domestic lounge access every quarter

NA

2 Reward Points on every retail spend of Rs. 100 and 5x Rewards on groceries and departmental store purchases.

Get 4 complimentary golf rounds every year.

Get an insurance cover worth Rs. 20 lakhs against personal accidental death

The accumulated Reward points can be redeemed against various options available on the BoB Rewards portal. 1 Reward Point = Re. 0.25

Get 2 complimentary domestic lounge access every quarter (8 per year)

Get a zero liability protection against a lost/stolen card on reporting the loss to the bank in a timely manner, preferably within 48 hours.

No data available

No data available