Benefites of SBI Credit Card Total Benefits...

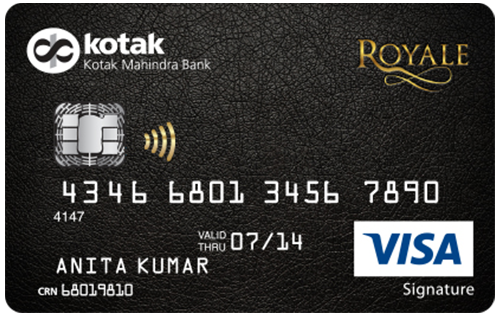

The Kotak Royale Signature Credit Card is a basic card offered by the Kotak Mahindra Bank in order to deliver its cardholders with thrilling Reward offers and travel benefits. The card has zero joining fee and offers opportunities to earn Reward Points for all your spends. You get 2 Reward Points for Rs. 150 spent with this card, and 4 Reward Points per Rs. 150 spent on selected categories, such as hotels, restaurants, and international spends. On reaching the milestone spends, you can earn up to 30,000 bonus Reward Points every year. In order to make its customers’ travel experiences even better, this card provides complimentary access to domestic lounges every quarter to several participating lounges in India. Moreover, you can save a lot on fuel & railway transactions with this card as it comes with a fuel and railway surcharge waiver. There are a number of more benefits of the Kotak Royale Signature Credit Card. To learn about all of them, keep reading the following details:

New Features

The renewal fee can be waived if you spend Rs. 1,00,000 or more in the preceeding year.

3.4% per month

Nil

Nil

1% fuel surcharge is waived at all fuel stations.

3.5% on all foreign currency spends

Rs. 300 per Rs. 10,000 withdrawn

NA

You get complimentary airport lounge access every year.

NA

2 Reward Points per Rs. 150 you spend. 4 Reward Points per Rs. 150 you spend on select categories like restaurants, international spends, Airlines, hotels, etc.

NA

Coverage of Rs. 2.5 lakhs against fraudulent transactions on a lost/stolen card.

The Reward points are redeemable on https://kotakrewards.com/ against various categories. 1 RP = 18.75 paise.

2 complimentary access to domestic lounges per quarter

The cardholder will not be held as liable for any fraudulent transactions done if the card is reported lost or stolen to the bank.

No data available

No data available