Benefites of SBI Credit Card Total Benefits...

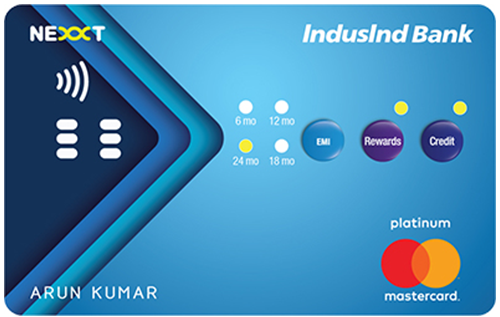

IndusInd Nexxt Credit Card is a unique card launched by IndusInd Bank. It is India’s first interactive and hassle-free card which enables you to make swift, secured, and convenient payments by taping on the button provided on the card itself. It gives you 3 options to choose between while making payments namely; EMI, Rewards, & Credit. You can choose any of the three options at your convenience. With this card, you earn 1 Reward point on every Rs. 100 you spend and redeem these points against several options of your choice. This card also offers benefits like ‘buy one get one offer’ on BookMyShow.com, Nexxt Auto Assist like – roadside repair, emergency towing, medical assistance, keys locked in, etc. Moreover, you can save on fuel transactions by getting the 1% fuel surcharge waived off every time.

New Features

NA

3.83% p.m.

Nil

Rs. 100

Avail 1% fuel surcharge waiver on transactions between Rs. 400 – Rs. 4000

3.5% on the conversion amount

2.5% or a minimum of Rs. 300

Avail of “buy one get one offer” every month on BookMyShow.com and Satyam Cinemas

Complimentary Priority Pass Membership

NA

1 Reward Point per Rs. 150 spent

NA

Get personal Air Accident cover up to Rs. 25 Lakhs

1 RP = Re. 1 for redemption against cash credit & 1 RP = 1 InterMile / CV point.

NA

You won’t be liable for any fraudulent transactions made on your card if the card is reported lost/stolen to the bank in a timely manner.

No data available

No data available