Benefites of SBI Credit Card Total Benefits...

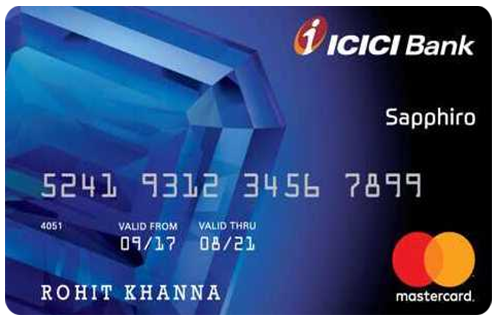

ICICI Bank Sapphiro Credit Card is the second most premium card offered by the bank, just after the ICICI Emeralde Credit Card. The Sapphiro is issued with a yearly fee of Rs. 6,500 and you can experience an array of privileges, attractive offers, and user-friendly features. The card comes with three variants – ICICI Bank Sapphiro AmEx Credit Card, ICICI Bank Sapphiro Visa Credit Card, and the Mastercard variant. However, only the Visa variant is being issued currently. The card is not only best for frequent travelers, but also for people who aim to have a card with maximum saving opportunities, entertainment benefits, and many more other advantages. With exclusive welcome benefits worth more than the joining fee, the ICICI bank aims to give a great start to your journey with this card. You get rewarded for almost every purchase you make using your ICICI credit card. Earlier, the cardholders were rewarded with Payback Points, but now the bank has replaced the Payback Program with the ICICI Rewards program and hence the cardholders will now earn ICICI Reward Points. Be it domestic/international purchases, utility bill payments, fuel purchases, or anything, you will save every time you spend. The Sapphiro credit card has a number of exciting features that you must know. Read on to get detailed information about the card:

New Features

Renewal fee waiver on spending Rs 6 Lakhs annualy.

3.4% per month (or 40.8% per annum)

Nil

Rs. 99 (plus applicable taxes) per redemption request

1% of Fuel Surcharge Waiver (Maximum Rs 250 per billing cycle) at all fuel stations in India.

3.50% of the total transaction value.

2.5% of the total transaction amount (minimum Rs. 300)

Get Rs. 500 off on the second movie or event ticket when you buy one ticket from Book My Show.

Complimentary Domestic & International Airport Lounge visits and complimentary Spa Sessions at select Domestic airports under the Dreamfolks Membership Programme.

2 complimentary International Airport Lounge Access every year through the Dreamfolks membership.

On every Rs. 100 spent, get 4 Reward Points per Rs. 100 spent on international purchases & 2 Reward Points on domestic purchases.

Complimentary golf rounds/lessons every quarter

Air accident insurance (worth Rs 3 crores), Credit Shield Cover worth Rs 50,000 and other travel-related Insurance Covers.

Redeem reward points earned for cash back or gifts at a rate of 1 RP = Re. 0.25.

2 complimentary domestic lounge visits with the MasterCard & Amex variant each, and 4 complimentary domestic lounge access with the Visa variant.

Lost card liability (worth Rs. 50,000) is applicable from 2 days prior to reporting and till 7 days after reporting the loss to the ICICI Bank.

No data available

No data available