Benefites of SBI Credit Card Total Benefits...

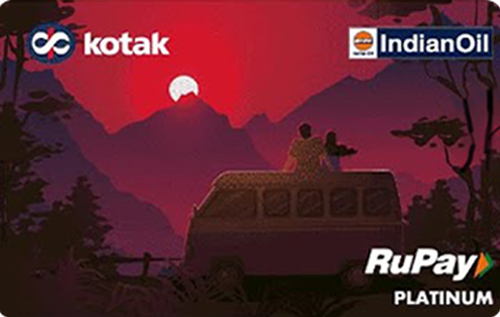

Recently, Indian Oil and Kotak Mahindra Bank joined forces to launch their co-branded fuel credit card. The IndianOil Kotak credit card is a nice entry-level card perfect for those who are new to the credit scene and want great fuel-based benefits and other rewards. Indian Oil has more than 34,000 outlets across the country and cardholders will be rewarded every time they refuel their vehicle at an Indian Oil fuel station. The card also offers reward points on grocery, dining, and other payments. These reward points can be redeemed for free fuel, cashback, or other products and vouchers at kotakrewards.com. The IndianOil Kotak credit card can reward you with up to 60 litres free fuel every year along with a host of other benefits. Those who travel a lot can reduce the effect of high fuel prices through this card and can have a highly rewarding experience if they prefer IndianOil petrol pumps over other countries. Keep on reading to know more about this newly launched fuel credit card by Kotak Mahindra Bank and IndianOil.

New Features

Annual fee is waived on spends of Rs. 50,000 or above

3.5% per month or 42% per annum

Nil

Nil

1% fuel surcharge waiver on transactions between Rs. 100 to Rs. 5000

3.5%

Rs. 300 per Rs. 10,000 withdrawn

Get 12 Reward Points on spending Rs. 150 on dining. You get 2% back as reward points on your dining spends.

NA

NA

Get 24 Reward Points on every Rs. 150 spent on fuel. Get 12 Reward Points on every Rs. 150 spent on grocery and dining. Get 3 Reward Points on every Rs. 150 spent on other transactions.

NA

Insurance cover worth Rs. 2 Lakhs for personal accident

Reward Points can be redeemed as cashback or to buy merchandise, products, and vouchers on kotakrewards.com. You can redeem your Reward Points for IndianOil XTRAREWARDS as well.

NA

Cardholder will not be liable for fraudulent transaction on reporting the loss of his card in a timely manner to the bank

No data available

No data available